wake county nc sales tax rate 2019

The total sales tax rate in any given location can be broken down into state county city and special district rates. A Transit Improvement Area sales tax increase affected rates in.

Taxes Cary Economic Development

You can print a 725 sales tax table here.

. The Wake County Sales Tax is collected by the merchant on all qualifying. The minimum combined 2022 sales tax rate for Wake County North Carolina is. The 725 sales tax rate in Wake Forest consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax.

Includes the 050 transit county sales and use tax. The Wake County sales tax rate is. The 2018 United States.

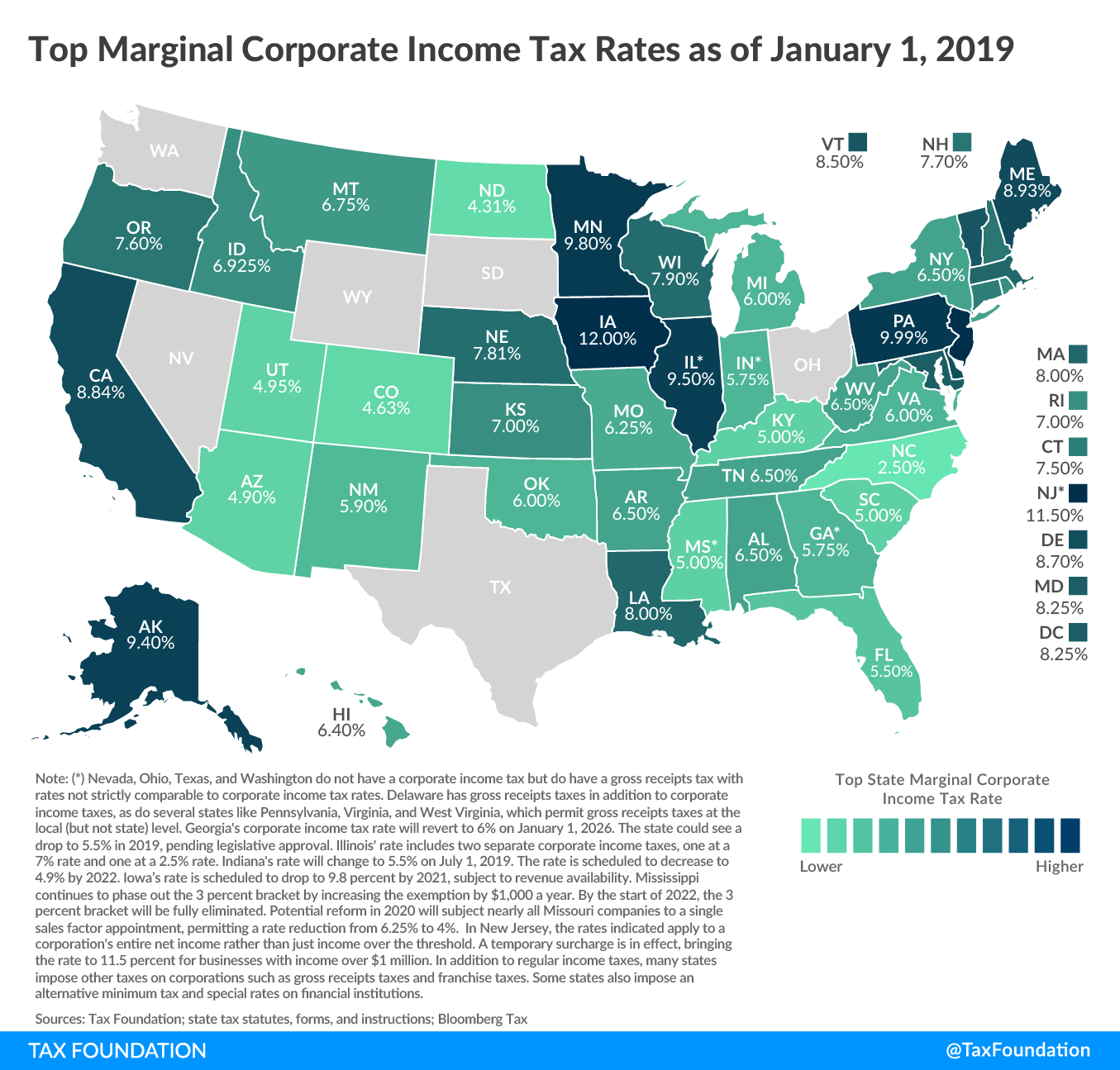

025 lower than the maximum sales tax in NC. The corporate income tax rate for North Carolina is 40. Did South Dakota v.

The North Carolina sales tax rate is currently. The Washington sales tax rate is. Sales and Use Tax Filing Requirements.

Sales and Use Tax Rates Other Information. The property is located in the City of Raleigh but not a Fire or Special District. The Wake Forest sales tax rate is.

Plus 20 Recycling fee 196600 estimated annual tax. The state will phase-in a single sales factor in the 2016 and 2017 tax years with a 100 sales factor imposed in the 2018 tax year. Apply now through June 1 2022.

Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect. The minimum combined 2022 sales tax rate for Washington North Carolina is. PO Box 25000 Raleigh NC 27640-0640.

There is no applicable city tax. The latest sales tax rates for cities in North Carolina NC state. The December 2020 total local sales tax rate was also 6750.

There is no applicable city tax. There is no applicable city tax. The minimum combined 2022 sales tax rate for Wake Forest North Carolina is.

Wilmington NC Sales Tax Rate. Did South Dakota v. North Carolina Sales Tax.

Wayfair Inc affect North Carolina. Historical Total General State Local and Transit Sales and. This is the total of state county and city sales tax rates.

2000 x 9730 194600. Wake Forest NC Sales Tax Rate. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes.

You can print a 725 sales tax table here. Sales and Use Tax Rates Effective April 1 2019 NCDOR. 2020 rates included for use while preparing your income tax deduction.

There is not a local corporate income tax. The new Wake County property tax. 025 lower than the maximum sales tax in NC.

For tax rates in other cities see North Carolina sales taxes by city and county. The County sales tax rate is. The 725 sales tax rate in Cary consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax.

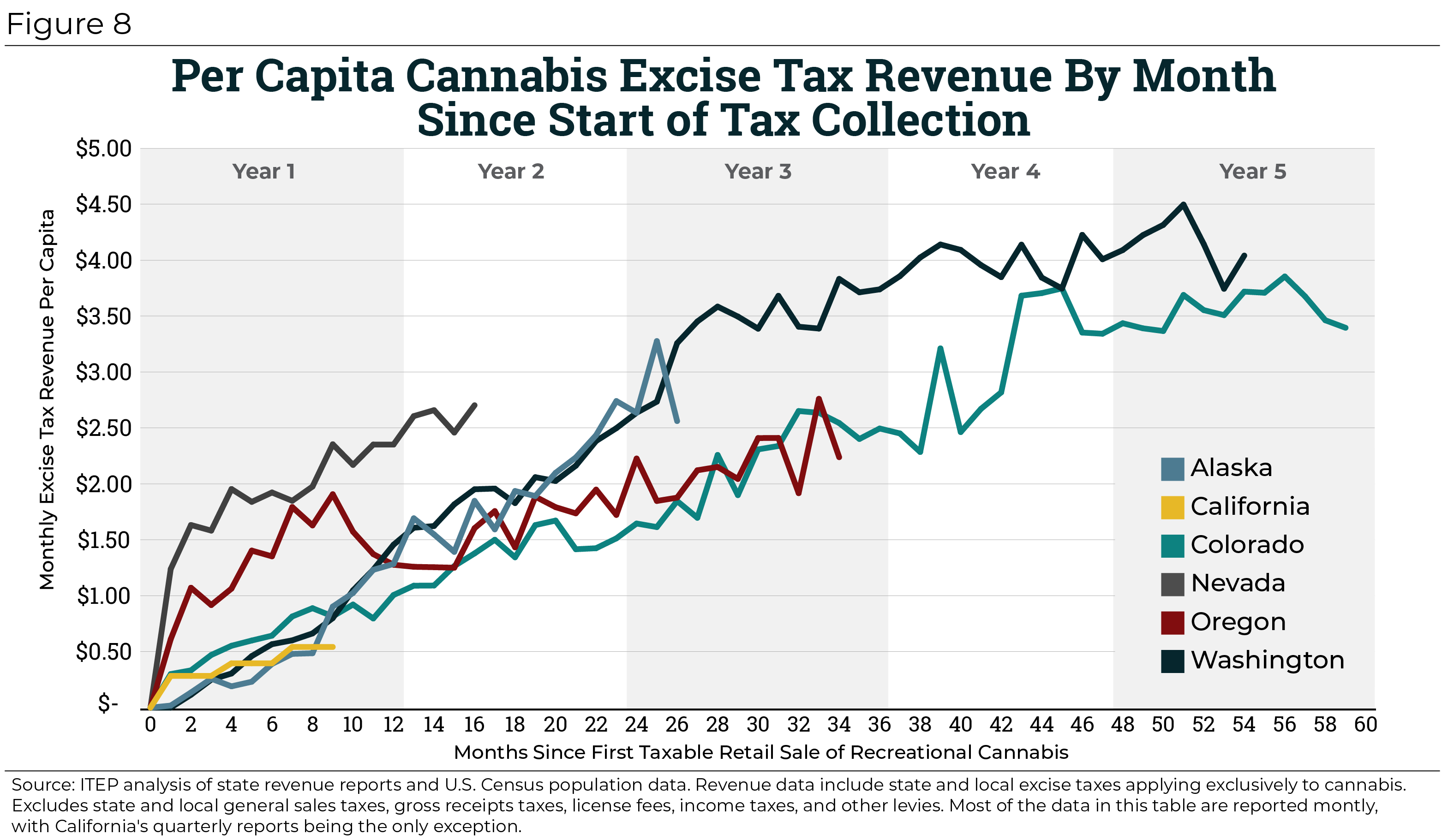

County rate 60 Raleigh rate 3730 Combined Rate 9730 Recycling Fee 20. This rate includes any state county city and local sales taxes. Nearly all of these increases stemmed from ballot measures though local government officials in Wake County North Carolina of which Raleigh is the county seat authorized a rate increase in 2017 as did officials in Albuquerque New Mexico and the District of Columbia in 2018.

The current total local sales tax rate in Wake County NC is 7250. Wake County leaders voted for the measure 6-1 to adopt the 147 billion budget for 2019-2020. Many businesses that did not qualify in Phase 1 are now eligible to apply in Phase 2.

The North Carolina state sales tax rate is currently. 35 rows Sales and Use Tax Rates Effective October 1 2020. This table shows the total sales tax rates for all cities and towns in.

The 725 sales tax rate in Raleigh consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. 2020 rates included for use while preparing your income tax deduction. Business Recovery Grant Program Phase 2 of the Business Recovery Grant program is now open.

West Raleigh NC Sales Tax Rate. The corporate income tax rate for North Carolina will drop to 30 starting January 2017. Historical Total General State Local and Transit Sales and Use Tax Rates.

There are a total of 460 local tax jurisdictions. The County sales tax rate is. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc.

025 lower than the maximum sales tax in NC. For tax rates in other cities see North Carolina sales taxes by city and county. This is the total of state and county sales tax rates.

North Carolina Department of Revenue. Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates. The North Carolina sales tax rate is currently.

Wayfair Inc affect North Carolina. You can print a 725 sales tax table here. For tax rates in other cities see North Carolina sales taxes by city and county.

Sale and Purchase Exemptions. The December 2020 total local sales tax rate was also 7250. Average Sales Tax With Local.

The current total local sales tax rate in Vance County NC is 6750. North Carolinas second most populous county will see the new measure take effect on July 1. The latest sales tax rate for Raleigh NC.

Rates include state county and city taxes. This is the total of state county and city sales tax rates. 35 rows Sales and Use Tax Rates Effective October 1 2018 Through March 31.

A single-family home with a value of 200000. Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates. Property value divided by 100.

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275.

Sales Taxes In The United States Taxable Itemsและcollection Payment And Tax Returns

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Sales Taxes In The United States Wikiwand

These States Have The Highest And Lowest Tax Burdens

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Taxes Wake County Economic Development

Taxes Cary Economic Development

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Sales Taxes In The United States Wikiwand

How Proposal To Redistribute Sales Tax Revenue Would Affect Triangle Counties Raleigh Chapel Transfer Raleigh Durham Chapel Hill Cary North Carolina Nc The Triangle Area City Data Forum

File Sales Tax By County Webp Wikimedia Commons

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Sales Taxes In The United States Wikiwand

Property Taxes By State Embrace Higher Property Taxes

North Carolina Sales Tax Small Business Guide Truic

North Carolina Nc Car Sales Tax Everything You Need To Know

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue